TESTING SERVICES FOR BANKING SECTOR

Digital Transformation is the future of Banking Industry, as indicated by the upcoming trends and digital initiatives like Mobile Wallets, P2P transfers, Ping Pay, Omni Channel Banking etc. As per Juniper Research, by 2017, more than 1B mobile subscribers (15% of global mobile subscribers) will be using mobile banking.

OUR TESTING OFFERINGS FOR BANKING INDUSTRY

Following are a few challenges of the Banking sector:

These massive regions help us provide complete-fledged aid for External Interfaces associated with the Aviation enterprise including GDS, Timatic, SITA, APIS, Payment, Cargo, and many others.

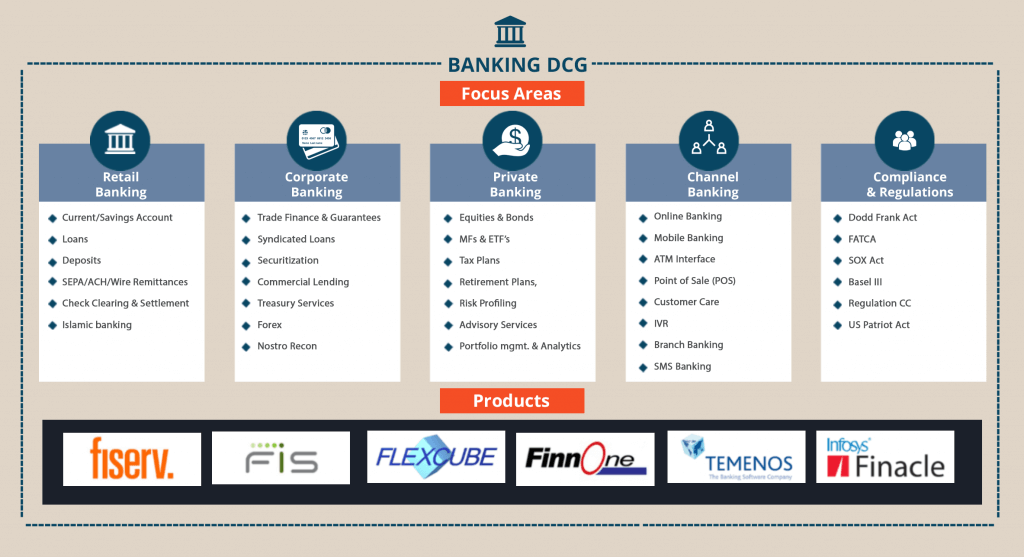

Our domain capabilities in the Banking sector span across the following:

Following are a few benefits of engaging with TGGTECH:

TGGTECH’S BANKING SERVICES DOMAIN COMPETENCY GROUP

Tools and Accelerators

TGGTECH with its acclaimed experience within the Banking space has well-tested tools and accelerators which could positively impact the effort worried and the time to the marketplace for its customers.

Delimit-Ex

TGGTECH’s Banking DCG has engineered Delimit-Ex, a one-step way to decrypt and examine multiple monetary files such as EFT and ABA. Delimit-Ex reduces the ache involved in deciphering the financial files with the aid of robotically decrypting the files and exporting them in the humanly readable layout. This reduces the checking out time with the aid of round 40% and the tester can only cognizance on finding defects and not fear approximately reading the files.

The device is also reverse engineered to create test files in various codecs and is embedded with fundamental auto validation abilities.

Re-usable Test Artifacts

TGGTECH has leveraged on its full-size experience of testing banking packages and has come out with a time-honored prepared to apply Test Repository comprising of test eventualities for key trendy enterprise flows resulting in excessive reusability and short transition. This will allow testers to jump begin their testing on new initiatives of a comparable type. We presently have round 10,000 check instances encompassing various Banking modules like Account introduction, Deposits, Loans, Payments, Mortgages, etc.

Automation Framework

TGGTECH’s Test Automation Framework (CTAF) is a device agnostic framework and can be used to a couple of programs/mobile gadgets with minimal re-work. TGGTECH is likewise in partnership with HP and has brought QA Automation answers to over 30+ happy banking clients. This framework is reusable & modular (25% reduced efforts) and permits to jumpstart Test occasions (30% faster), supply faster answers and recognize extra ROI. The framework is pro-agile with CI gear which includes Jenkins.

What Clients Says

Contact Us

Consult our experienced team of career testers for your Testing requirements.

OUR THOUGHT LEADERSHIP

The 5 Myths of Security Testing You Should Stop Believing

Testing Integrated Trading Platform – An approach